Transcript

Jim: Great to have you. Tell us about AccrueMe. Fill us in.

Donald: Sure, well, first off, I have to tell you, we’re very, very excited to be working with you and Proven. We love the network. We love what you’re doing. In fact, God’s honest truth, yesterday I referred somebody over to Proven and they responded back to me, this is unbelievable. They’re literally buying a similar course that was for thousands of dollars and I sent them over to you. I said, “The guys teaching this course learned it over here,” and needless to say, that seller is very, very happy.

Jim: I appreciate that, man.

Donald: I’m a believer.

Jim: It is a very blue ocean out there so you’ll never catch me saying anything negative but we’ve been doing this right for 17 years or so and we have lost a lot of the other gurus out there repackaging and bumping the price up on our stuff. Hey, more power to them, but appreciate the shoutout. That’s awesome. I know you’re very plugged in. You’re going to a lot of shows, meeting a lot of movers in this industry. Your perspective is invaluable as well as the funding options that you have. Let’s dive into all of that.

Donald: Sure, I’ve done so many different things out of this industry and then got into this industry just a few years ago. For me to make any kind of headway, I had to meet all the leaders in the industry. I went out and I focused on that initially. What I found and was really great and I still get the same comments, the biggest leaders in this industry saying to me, “Thank you so much for bringing good capital to our industry.” They mean it because what we’ve done is we’ve created something that I’ve never seen before, a finance arrangement that’s actually fair. There’s always a catch. I’ve been in finance my whole life. There’s always a catch. It’s amazing to do something that we only win when the seller wins. When the seller doesn’t win, we don’t win. In other words, we don’t earn any money. They don’t owe us any money. It is fantastic. Basically, what we put together, Jim, is we sat down and we thought about it and we said, all right, how can we help the seller? We’ll give the sellers capital to grow their business. This is all growth capital. This is not for paying bills for two weeks, things like that. This is to grow your business to make a lot of money. We’ll give them the money to do that. We won’t charge them any interest. We won’t require any monthly payments. It’s up to them. There are no fees. A lot of times the first question that would go through my mind is, all right, what are the fees? There’s got to be something hidden somewhere.

Jim: No credit check. It’s based on the strength of your account basically, right?

Donald: We’re just looking at the inventory. There’s no personal guarantees either. You have nothing hanging over your head. You’ll sleep well at night. It’s a business transaction. What we do is we just earn a percentage of profits. How do we set up the percentage of profits? Again, thinking about starting a business, how do you do that? My partners and I, we said, “Let’s do it this way. This way the sellers can only win.” When you set up something the way the sellers can only win, it’s fantastic. It feels good. You feel really good giving it out. You want me to give you a quick example?

Jim: Yeah, please do. I’m familiar with it, but for the listeners’ sake, I love how this is different from every other model that we’ve seen. We have some, in full transparency, we have some other great sponsors in this community that do funding options, but you guys are in a category by yourself, which is why I’m doing a whole podcast episode inviting you guys in. It’s a very unique arrangement that you guys have. It feels more like a partnership versus a loan shark. You’re jumping into the biz with us kind of feel.

Donald: Exactly, literally, we only win when you win. When we started the business, in our first corporate meeting, we all got together and I made a little announcement. I said, li sten, as we’re growing this business, please don’t ever come to me and say, “Hey, we can make more money if we do this.” No, come to me and say, “Our sellers can make more money if we do this,” then that works. Because when our sellers make more money, we make more money. It’s almost like a variable cost. Anybody in business for any period of time, you know this, if you can make your cost variable, that’s a homerun. As you’re growing, you’re going to pay a little bit more. As you have a bad month or two or a quarter, you’re going to pay less. It’s a beautiful thing. It’s like having a part-time person and you’re doing really well so now they go from 10 hours a week to 20 hours a week. You’re doing really well. Now they’re up to 30 and 40 hours a week. You need a second part-time person. Now all of a sudden you come into some bad months, well, you don’t need that part-time person. They go away in a day and your expenses come down the same way, so anyway –

Jim: It’s almost like a virtual assistant that’s there when you need them. That’s where I see you guys fitting into the structure. I don’t know if anyone’s used that analogy yet or not, but a lot of the other funding options, it feels like you’re hiring someone full-time. I better find something for them to do. They have to pay for themselves somehow. Whereas if you have a VA that’s like, hey, I’m here when you need me, let me know. You throw them some work when you need it, and when you don’t need it, they’re off doing other things. It feels like that from a risk perspective.

Donald: It’s a great analogy. I like it. I’m going to give you an example. I’m going to keep the numbers just simple, $10,000. It could be any number. It could be $100,000. It could be more. A seller has $10,000 of inventory cost and including whatever is due to them from Amazon so call it $10,000. Let’s say they’re earning 20% on that per month. I was listening to one of your podcasts recently, the guy with thousands of products to buy, he was earning a lot more than 20%, which was great. It was really fantastic. Most of our arbitrage guys earn a lot more than that as well.

Jim: Yeah, we see a lot of ROIs 100%+ and then we’ll see a lot of net net margins of 20% is on the low end, we’ll see up to 30% or so typically once you’ve calculated all of your cost with the model that we start most of our students at and most of our most exciting success stories are in that model as well right now, for sure, so 20% is a very fair number to play with.

Donald: If it’s 20%, if it’s 10%, it doesn’t much matter. It all works. I’m just using this as an example. You have $10,000. You’re going to earn 20%. You’re going to earn $2,000 in profit. Now if we give you another $10,000, let’s assume you can do the same numbers, you’re going to earn 20%, so now you’re going to earn $4,000. Sounds good but AccrueMe has to earn something there. We’re not charging you interest, and again, you don’t have to make monthly payments. There are no monthly payments. What does AccrueMe earn? Whatever percentage of the capital we represent. You have $10,000. We give you $10,000 in this example. We represent 50% of the capital. Whatever our percentage of the capital is, cut it in half, so in this case it’s 25%.

Jim: You guys get $1,000.

Donald: $1,000, that’s how much we would earn that month. If we represented 10% of the capital, we would get 5% of the profit, and it changes each month. In this case, you earn $2,000, then you earn $2,000 on our money. Now, AccrueMe is due $1,000 of that. You say, “Hey, Don, we have more opportunities to grow. We don’t want to pay you $1,000.” All right. Leave it in the business. Keep that money. Now, month one, you had $10,000. Month two, you had $20,000 with AccrueMe’s money. Month three, assuming you leave your money in as well, you have $24,000 to grow, and in month four, you’re going to be close to $30,000 in your business. Just to put it in perspective, what does AccrueMe get? AccrueMe got that $1,000. What do we do if you decided on month two, month three that we don’t want to do business with you anymore, whatever, doesn’t matter, whatever your reason is. Fine, you owe us $10,000 that we invested plus the accrued profit of $1,000, that’s it. End of story and we go away.

Most people don’t do that. We have more and more and more sellers that are using us to grow rapidly over a year or two years and they’re thinking about selling their business or they’re just making so much money. When they’re making that much money – we have so many of these examples, so many case studies of this, which fills you up, but our very first clients, I think you’ll love this. They’re in their 70s. They’re still clients of ours. It’s been about two and a half years. When we looked at their account, they were making very little, very little money when they first started. Over the next 18 months, they took their business from a net profit, net to them, of $9,000, to a net profit of $120,000 some odd to them, after assuming AccrueMe was paid. They didn’t make a single payment for 18 months, not one. We never asked them for one. Now in the 19th month, they were flushed with cash. They just had so much money because they built their business to such a size that they could pay all their bills and live and everything was good. They sent us $2,000. The next month they sent us $3,000. The next month $5,000. The next month they sent us $10,000. I thought they were going to pay us off. What they did was they stopped there. They continued along on a good path. Now we’re going into Q4, they just reached out, they’re looking for more money now. Whatever they need is in their account in an hour so that they can take advantage of these opportunities. Let me just say one more thing and then I’ll shut up.

Jim: No, you’re doing great. I have a few questions for you but this is awesome. I think a lot of people are having lightbulb moments right now thinking, okay, where’s the catch?

Donald: Yeah, everybody asks that – people say where’s the catch and it sounds too good to be true. It is what it is. It’s all real. Here’s the theory. I think the theory is important because it blows up lending really is what it does. I’ve been a lender my whole career. If you think about it, if you have opportunities to grow, why would you take money out of your business to send it to the bank? It makes no sense. Why not, if you have opportunities to grow, use all that money to grow? Go out and buy more product. Take advantage of those opportunities. Then when you are flushed with cash, then send money to the bank. When you do that –

Jim: The thought I’m having right now, Don, as I’m listening to you, buddy, is we need some politicians that think this way because the biggest bill I pay every year is my tax bill. I’m thinking, man, I could have done – I could have hired people. I could have bought inventory. Just let me hang on to it a little longer, please. No, it’s time to cut you in half at the knees, buddy. You’ve had a good year. It’s so painful. Let me grow this thing, please. That’s what you guys do, though, is you let it grow. You let the money mature and pay you back when you can. It’s like a loan from an uncle that’s like, hey, pay me back when you can. Give me a little piece of the pie when you grow. One of the questions I have for you, Don, not to sidetrack you, but I’m sitting here thinking, why this industry? You and I have talked a little bit prior to this but I haven’t heard your answer to this necessarily because I know you were in retirement and you were doing your thing and the Amazon seller market and their need for funding caught your attention and got you fired up. Why this market? What is it about this that’s so exciting from a lender’s vantage point? Someone with money looking for somewhere to put it is excited about Amazon sellers right now. Why is that?

Donald: I wasn’t. I wasn’t looking at all. I had no interest at all. However, I was talking to an old friend from the mortgage industry about finance and people growing businesses and small businesses. He knew even though I was retired, the one thing I never stopped doing is mentoring specifically young people. Older people as well and just trying to help any which way. I can tell you a story about that that hits home right now with Afghanistan where I talked a person from a state department who was recently – he just hated his job. He was over in Afghanistan I think 18 times for months at a time away from his family. He was just hating his job. I said you’re in the government. You should move away from that and get another job that allows you to have a life and a family and the whole bit. Anyway, he shortly went out and changed his career and he’s now at the department of justice based in New York, doesn’t have to travel anymore, moved to New York, is happier than you could ever imagine.

Anyway, I love mentoring people. I just do. If I can help somebody, I do it all the time. If I can refer them over to Proven and save them some money and give them the right course, man, I am thrilled to do it. With that in line, my now partner said to me, explain to me about Amazon sellers. I knew nothing about it. I thought everything came from Amazon. I had no idea. He told me about it and with thousands and millions of sellers and I couldn’t sleep that night because this is the picture I had. I don’t think I’ve ever told anybody this. I pictured myself on stage. I was picturing myself like a Jim. I would be on stage talking to thousands of people and teaching them how to quit their day jobs and start their own business. I’m a firm believer, I wrote a book about it, about quit your job. It makes no sense.

Jim: Give us a shoutout, man. Is the book on Amazon?

Donald: It is. I’m actually just one chapter in the book. It was co written with Brian Tracy so there were multiple chapters. I don’t remember the name of my chapter offhand but I just saw the book. I googled myself –

Jim: Which book of Brian’s? I have a great deal of respect for him. I actually got to speak right after him one time. It was terrifying.

Donald: Oh, my God. That would be terrifying. It was called Transform. It was all about starting your own business. That’s a dream. I couldn’t sleep that night because picturing Amazon sellers and I could help them by teaching them the business and teaching them to get out of the daily grind and grow a business. I didn’t know anything. What I did was I called my accountants the next day. It’s a big accounting firm in New York and I asked them do they have any Amazon sellers. They got back to me and they sent me three referrals. I called all three. It just so happened one was very small. He had $5,000 of inventory. One was a good size. He had $100,000 or $150,000 in inventory. The third guy had I don’t remember if it was $1.5 million, $2 million in inventory. It was big. I called them all, had great conversations. I just wanted to learn about the industry. They were teaching me about FBA and FBM. I never heard these terms before. They’re teaching me about this. At the end of each conversation, I asked them one question. What do you need? They all had the exact same answer. We need capital. There’s no good sources of capital. I’m like, wow, okay, that’s right up my alley.

I did the research and I first one I looked at, I’ll never forget the ad. It said, borrow $10,000, pay back $11,000, it’s that simple. I’m like, wow, that sounds great. I can’t compete with that. Then I ran a spreadsheet. When I ran the numbers, I realized that the seller can’t make any money with that guy, with that lender, and the lender is still here. I’ll give you real quick, using the same ROI numbers of 20%. On that $10,000 assuming you’re earning 20%, you’re earning $2,000. Your monthly payment was $18.56. You just signed personally on a loan for $10,000 and took on all that risk to earn, if everything goes well, $150 a month. It makes no sense at all. The lender makes out like a bandit and the seller is taking all this risk. I didn’t want any part of it. With that, I went to my partner and said, “I don’t want any part of it. This is not what I like to do. It’s got to be a win-win.” That’s when he suggested, why don’t we partner with the sellers? Then we just went from there and we sat around and had lunch and for hours after over a few days we came up with this model and we perfected it and it works.

Jim: I want to get into – thank you for that, by the way. I know that smart money finds good places to sit and grow and you come from the world of dealing with people with smart money. That’s not a world that I’ve played in a whole lot. I played in the arena like you just talked about, being on stage, and hey, you can build a business. Here’s how. As you start to grow, that is the thing, one of the themes, one of the messages you hear in our community all the time is I run out of money before I run out of good stuff to sell. It happens all the time. That’s literally the theme of our fourth quarter training groups is you’ll run out of money before you run out of stuff to sell and flip. You’re coming in solving that problem saying, hey, we’ll keep a little of this piece but let’s grow this together.

I love this model. It’s a true partnership. I love that you dig into the business. It’s not a credit score check. It’s show us your inventory. How’s it selling? We’ve got a picture now. Here’s how much money we can give you. You’re qualified for a lot of assistance if you’ve got a successful profitable Amazon business of just about any size. I want to get into the specifics of, I know you guys have a special offer for our community. You guys talked about it. You guys were at our event and people loved you. You had some great conversations with the guys you sent to the event and just really good genuine guys. They had a $500 offer. Is that something that’s still active, something people can take advantage of? If so, talk me through that.

Donald: Yeah, we’re setting up a link for everybody on this podcast or anybody through Proven and Silent Jim. When they apply with us, by applying, I mean, basically filling out a little questionnaire. It takes about two to three minutes. Then from there, we’ll give you an estimate and then from there we ask for access to your Seller Central account just to see what your inventory is and all, and then we give you a firm offer and we call and talk to you and explain every detail and make sure we’re 100% on the same page. Anybody that applies and is funded through Silent Jim and Proven –

Jim: The link we’re going to use is silentjim.com/funding. We’re still setting it up as we’re recording this, but as you’re listening, it’s ready to rock, silentjim.com/funding.

Donald: Perfect, and you’ll get an extra $500, not as an extra $500 that you owe to AccrueMe eventually. No, it’s yours. You do whatever you want with it. You don’t owe us. If we gave you $10,000 for your business, there’s another $500 that is yours. We assume you’d use it for your business. We assume you’ll buy more inventory, but if you don’t, you don’t. That’s up to you.

Jim: Beautiful, that’s a great arrangement.

Donald: Yeah, nice little bonus.

Jim: Yeah, and that just reflects how confident you guys are in your process, too, to me. You’re a finance guy. You’re a numbers guy. I always know if I’m dealing with numbers guys. I just actually did a podcast episode not too long ago a few days before this one with another finance guy talking through this business model. He’s never seen anything like it. He’s working full-time in finance helping other businesses fund and he’s growing his own business in his part-time, spare time. He started with $500 ironically enough. That’s all he’s put in. He’s expecting to do a quarter million now just rolling it over in his first year. This is part-time. That’s how good we are.

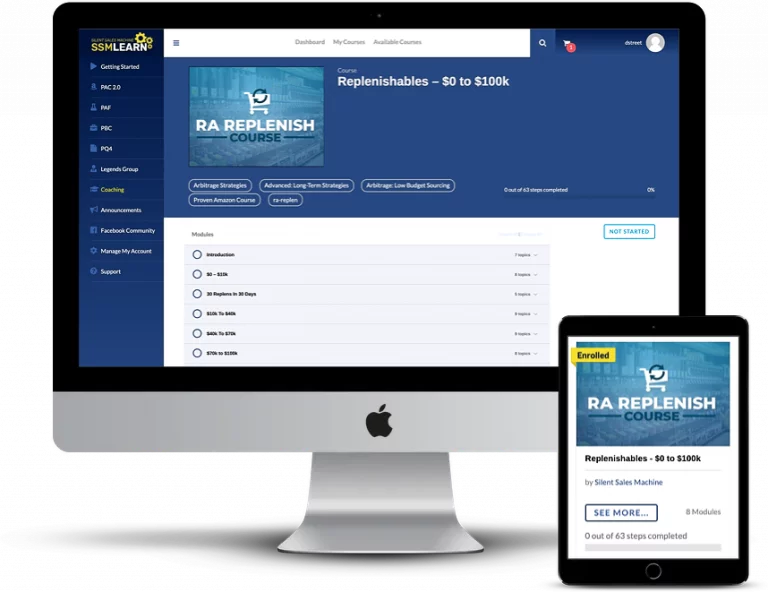

If you look at the landscape of the different ways that you can approach Amazon, there’s several ways to take advantage of this platform that’s been built. It’s an amazing platform. The one that I’m the most excited about if someone comes to me and says, “I don’t know much of anything and I don’t want to put a whole lot of money at risk. I want to put some money in the bank and build something substantial. What do you got for me?” It’s not private label. It’s not one of these thousands of dollars courses. It’s these we’ve systemized arbitrage basically. We call it the Replens model. These guys are cash hungry with a system where they’re turning $5 bills into $15 and $20 over and over and over again but they just need more cash. This is an exciting arrangement.

I love bringing you guys on board. I love the partner model, just the partner feel of we both have skin in the game now. You care very much now about this business. It’s not just a payment on your books that you’re collecting every month. We’re in this together now. Our capital is at risk with you guys. How’s it going? What are you doing? What are you up to? Do you need anything? You’ve got a partner who understands numbers in your business with you. That’s what I think has gotten me so excited. My first ever out of almost 400 podcast episodes that I’ve ever talked this much about funding and finance because I feel like you guys are doing it right.

Donald: We are. There’s no question. You know what else, Jim? You’ll love this. We’re not just giving them money and watching them grow. We’re cheering them on. We’re helping them in any which way we can. There’s communication that goes on. Literally, we’re rooting for them. I was at a conference yesterday and we had guys at a conference out in ASD and Vegas earlier this week. What do we do? In fact, we did it at Proven. If you came by our booth, you would have found a whole bunch of different products. These are all products that our sellers are selling. We bought them from our sellers because we love them. We really do. We want them to win. It’s so exciting to see it. Some of our sellers, we have regular calls with to coach them on their business. Look, not for anything, I’ve done many businesses, I’ve built many businesses to the tune of thousands of employees, 7,000 employees, I’ve done small ones, too, but I’ve got a lot of experience in a lot of different industries so to sit down for free with someone like that, and I do it all the time because I love it. If I can help somebody, I want to do it, whether –

Jim: I see this leading to more partnership opportunities, Don. We’re talking in real time here. This is a podcast episode but it’s also two guys talking about their own businesses and the people they love and work for every day. I’m just imagining some of these conversations you may get in over your head with an Amazon seller who’s in the weeds. You’re like, I’m finance, not Amazon. Send them our way. We’ll take care. We’ve been doing coaching for 17 years. In the industry, the next closest is like four or five years. We’ve been doing this a long time the right way. I’d love to work with you guys even closer on some of these, but I love that you guys are getting out there, going to shows, learning the ropes of this industry and you truly understand. It’s not a credit card that’s like, hey, payment due. It’s someone who’s in the mix, in the weeds, has a great deal of respect for what it is Amazon sellers are trying to do and trying to build, and again, I can’t emphasize enough, especially to this listening audience, you guys love the retail arbitrage model. Those are some of your strongest clients. Talk about that just a little bit so people don’t hear it from me but I want to hear it from you. What’s your perspective on a brand builder versus a third-party wholesale or retail flipper, the Replens model that we teach?

Donald: I like it all, but truthfully, when you’re starting out, if you jump into, as I coached somebody just yesterday at this conference I was at, she was jumping in and she was going into private label. She was a lawyer. I said to her, “You’re going to put a lot of money at risk. You realize that you might lose $20,000, $30,000 just to learn. Doesn’t make any sense to me.” I said, “If I was in your shoes, I would be doing wholesale,” and I honestly said to her I would be doing some arbitrage as well. Learn the industry. Learn Amazon. Amazon is this crazy thing out there that has a lot of detail. If you take the time to learn it without putting yourself at financial risk, you’re going to be strong, very strong, and then down the road look to get into private label. That’s fine because you’ll know what you’re doing.

Interesting story though, Jim. I’ve also taken some of our sellers who are big private label guys, good size, and when we sit down with them and look at them and try to coach them, I see their cash flow is great one month and it’s terrible the next month, then it’s great, then it’s terrible. What’s going on? It’s because of supply chain issues, we have such a difficult time to get out products. I’m running out of product. My inventory is gone. Now I get my inventory in. I have to increase all my advertising costs. My PPC goes through the roof. It’s killing me. I make no money as a result. Then I start making money, I run out of inventory again, and I can only order so much. With that guy, I said, “Why don’t you supplement your private label business for wholesale?” I introduced him to a great supplier who is just a good guy on footwear, like sportswear. I just saw him yesterday at this conference. He’s selling Merrell shoes through this supplier and it’s leveled off his cashflow so he’s not running out of everything all the time. He’s not rich one month and poor the next. He’s doing great.

It goes both ways. Where you should start is with arbitrage, wholesale, learn the business. I think my personal opinion from what I’ve been seeing, that takes more than a year. I would say maybe two years before you really, really, really are an expert in your business. In that period of time, start learning about private label. Go to conferences, talk to people, listen to podcasts, learn everything you can, do all the research you need to, and then chances are you’re not going to lose that $20,000 or $30,000, but I guarantee you, if you start that way, you probably will.

Jim: Yes, and just having been around this industry for a while, I love having an outsider’s perspective on this. You’ve talked a lot of sellers because the listeners to this show, if they’ve listened to more than, say, 30 episodes, let’s say, they’ve heard me say a handful of times now, you’re crazy to start with private label. The fact is, Don, I don’t know if you knew this or not, but if you get on YouTube right now and you say I want to learn how to sell on Amazon, 50 of the first 51 videos you’re going to come across are going to be shoving you into the private label model. They want to sell you a $3,000 to $5,000 course. They want to sell you software that costs $200 to $500 a month, coaching, and then you’re going to be waiting three to five months. By the time you’re through this nine-month, $30,000 process, you find out, woah, the game has only begun and my garage is full and my spouse is mad at me. That’s why we start people out with the, hey, you’re not going to find any problem finding your inventory. We’re teaching you how to find stuff off local store shelves all around you. There’s $5 bills sitting there that you can go turn into $20 bills if you’re willing to get in your car or hire someone to get in their car. The business is there. That’s the training ground for the wholesale and private label. We almost have like a pyramid structure of working your way up. I love that you guys have recognized the power and potential of this starting ground floor. If you ever talk to frustrated Amazon sellers, send them our way. We’ve reset the businesses of many, many sellers because those skills you have with private label, there’s some value there, but man, there’s money all around you. I love this is going to be a beautiful partnership going forward. Anything else you want to sell with – excuse me, share with me because you’re not selling anything. You don’t make any money until we do. This is a zero-pitch offer, but anything else you want to share with the community before we start to wrap this one up?

Donald: I think just have some fun, grow your business. As a general rule in finance, people ask about leveraging your business and when should I use leverage, meaning other people’s money, this is a big question and I think a lot of people don’t know that answer, the answer is really simple. If you have a business and you’re making money, if you’re making a profit today, then go out and get money and make more profit. Make it bigger and bigger and bigger. If you’re breaking even or losing a little bit of money, getting bigger will not help. Don’t even think about it. Figure out what’s going wrong with your business, change your products, change your attitude, change whatever, and fix your business first. Make it profitable. Then go out and get the money. I don’t really think there’s any other choice for money that’s safer than what we do or better than what we do if you want to grow.

Jim: I love it. I love the challenge you’ve laid out there. I would argue, too, that we live in the best time in human history to test small and to truly prove concepts out. You’re old enough, and I am as well, to remember when starting a business meant putting huge amounts of capital at risk. We were all told, hey, there’s about an 80% chance it’s going to fail but go for it. Be the guy that breaks all the rules and prove us all wrong. Now it doesn’t have to be that way. It just doesn’t. That lawyer you were talking to getting ready to flush $30,000 down the toilet, hey, for about $1,000 you can be pretty deep in proving this thing out over the next few months, learning the ropes, doing the work, and then go get some capital, like you just said brilliantly. Once you’re making some money, ramp it up.

Donald: Yeah, let me tell you one other quick thing that’s kind of interesting. Yesterday I was with a very large influencer in this industry and she trains people on private label. Her husband is doing arbitrage. How interesting is that?

Jim: I love it. I almost want to do some investigative work and figure out who that is.

Donald: I’ll never tell.

Jim: There’s times, Don, when I’m a lone voice in the wilderness because there’s not a lot of money to be made teaching people how to do the models that we teach people to start out with. We could charge more because we’re getting results but we just don’t. Our strategy has launched so many successful students. I mean, all you have to do is listen to this podcast and I think we’re the only ones in the industry doing it this way, 90% of our episodes are another successful student. Bam, Bam, Bam! We take our time and make sure you understand the basics before you write any checks with a comma in it, you know what you’re doing, including with us. We don’t want these big piles of cash being thrown – it’s just not necessary. Learn the basics. You can’t do that in real estate. You can’t go, okay, I’ve got $500 to spend. I want to succeed in real estate. That’s not how it works. In this business, that’s how it works. Start small. People come to us, Don, with large piles of cash, and I say keep all that in the bank. We’re going to need a few hundred bucks here and we’re going to prove this out and we’re going to ramp into it slow. It’s the biblical model.

Speaking of which, something that struck to me the first time you and I spoke and it jumped in and I presented this challenge to you and we had a great chat about it but I’ll present it to the listeners as well. I’ve studied Hebrew quite a bit. One of the things they understand in their culture is there’s a difference between investing and gambling. To your average investor or guy in the street, if you walked up and said, what’s the difference between investing and gambling, they may not know, and some listeners may want to pause and think it through, what is the difference? You’ve got your odds of success with one and you have your odds with the other. What is the difference? The difference from a biblical perspective is you either win together or you lose together in an investment, especially if there’s a partnership and a friendship and a relationship that’s formed there and back and forth accountability, like what you guys do. You win together or you lose together. That’s cool. With gambling, there’s always a big winner and a big loser. It separates the relationship, basically. Gambling doesn’t create strong friendships. It creates enemies. Someone is going to hate someone if this thing goes down the way it probably could tonight. Gambling creates enemies. Investing creates people who’ve lost together or win together. Just like parents, we love to see our kids either win or lose together and the lessons that go into it. I believe that’s God’s perspective – sees us win together, that’s great, sees us lose together, hey, you’re still together. You did it together. That’s okay.

That’s what I love about your model as well is just almost the intimacy of the partnership, the accountability. You dig in. You guys have the business experience. You love Amazon sellers. I haven’t committed this much time to this topic before. I think a lot of people are going to find it very interesting, however. I’m excited to be working with you guys for years coming. Send us some of those desperate Amazon sellers you’re running into because there’s a lot of them outside of –

Donald: I’m already doing it, and truthfully, because I believe. It’s not for no other reason. It’s because I believe 100% in your model and what you’re doing. When I looked into it, I was like, wow, this is the way it should be done. I’m 100% in.

Jim: I appreciate it. Mr. Don Henig, pleasure to spend some time with you, my friend. We’ll have you back again at some point as well.

Donald: Hey, can I just add one more thing, Jim?

Jim: Please do.

Donald: If anybody wants to connect with me on LinkedIn, feel free. It’s my full name, Donald Henig.

Jim: If you’re watching on YouTube, you can see your name in the bottom corner. We’ll stick it in the show notes, too, at silentjim.com, then the link for the offer, silentjim.com/funding to connect with AccrueMe as we can see on the well-made sheet behind you there. I want one of those backdrops. I need to get one of those for my office. I think mine looks a little prettier than yours. Yours has a nice marketing touch.

Donald: Now I always can remember the name of my company.

Jim: Yeah, if you forget where you are, you just turn around.

Donald: Real quick, you see how that logo goes where the arrow is pointing up, you’d be shocked, but at least 90% of our sellers, that’s what their model looks like. That’s what their spreadsheet looks like now where their business started down here, and over five, six, seven months, all of a sudden, they’re way up here. Would you rather earn $1,000 a month or $13,000 a month? Literally this is what our guys are going through. It’s fantastic.

Jim: What that tells me is you guys are good at what you do, which is finding winning business models and finding winners within that model. It tells me as a guy who’s teaching this model, I’m in the right industry with the right opportunities. I love it.

Donald: Yeah, me too.

Jim: Good hanging out with you today, my friend. God bless you. We’ll do this again soon, okay?

Donald: Thank you, Jim. I appreciate it.

Jim: All right. Talk to you soon.