Transcript

Jim: Let’s get right into your story. I’m eager to hear it. Joe, why don’t we start with you, buddy.

Joe: Yeah, we’ve had quite a journey. First of all, we’ve got a little boy who’s two years old and a little girl who’s, she’s almost seven. We’ve been married since 2012, so 2012 is about when we started with Amazon. We had just gotten married in April and got home from the honeymoon and we’re combining all our stuff together and trying to organize a little bit. I found a couple of textbooks lying around the house. I don’t know why, but I just decided, hey, I’m going to try to list these and get some money for them.

I put them on Amazon and they sold pretty quickly. Put a couple more on, and those sold, and then went from there. I started going on Craigslist and looking for people selling books. We live in a college town, so there were quite a few options. Craigslist was a little more busy back then, so I could buy them on Craigslist and I’d resell them on Amazon. Then I started doing that on eBay. It just went from there.

Julia: Him going to Goodwill’s.

Joe: Yeah, going to Goodwill’s and all kinds of thrift stores. That was my hustle for a while. I really liked it. It’s a lot of fun. At the time, we were really – we were in need of money. We were struggling. We were pretty late into our 20’s at that point. I don’t want to go off the rails too much.

Jim: No, was that a part-time gig for you guys or was that – that was your primary income?

Joe: Yeah, it was a part-time gig. Basically, at that time, I was in school. I was getting a master’s degree in counseling. I was doing that and I was working part-time.

Julia: I was working full-time, yeah.

Joe: You were working full-time at the time. We came in with a lot of – just a lot of debt. I’m actually a recovering alcoholic. In 2008, I went to rehab. It’s actually a faith-based regeneration program is what they call it. At that point, I really – I came out of there with a changed heart.

Jim: That’s beautiful. What’s the name of the program if you don’t mind sharing? I’m curious because I’m familiar with that world.

Joe: Yeah, it’s called Dunklin Memorial. It’s in Okeechobee, Florida. That’s a great place. They’re faith-based. It changed my life. It really did.

Jim: That’s phenomenal. Congratulations, man, congratulations. A day at a time, I love how you said it. You said it, recovering alcoholic.

My dad was – we lost him in December. He was clean and sober for over 40 years but called himself a recovering alcoholic until the day he passed because it’s a journey. He shared with me very candidly just months before – we didn’t know he was going to be sick and gone soon, but in a conversation, I was like, “Dad, is it – are you still truly recovering alcoholic or do you say that to be supportive to people?” He’s like, “Plenty of days where a good, cold beer sounds really good, but I’m not going to do it. There’s a lot more than me that would lose some faith and lose some heart if that happened.” I said, “I’m one of those guys too. You encouraged me.”

Congratulations on that gift not just to yourself but to your family. I can see Julia nodding her head up and down and agreeing right there. A topic of passion for me. My parents spent years in Celebrate Recovery. My mom still runs a local – one of the largest in Indiana Celebrate Recovery chapters, like a Christian Alcoholics Anonymous, but at a higher power, it’s unapologetically Christ-centered. Congratulations to you, man. I love that we’re starting there.

Joe: Thank you. That’s where I started. Even though I came out of there with a changed heart, I had a lot of baggage. I had put myself in a financially difficult position. By the time we got married, it was one of those things where we needed to figure a way out of it. It was a rough road afterwards.

Julia: It wasn’t just him coming into the marriage with baggage. I’d made my own financial mistakes. I had debt, too, that we needed to eliminate. We came into marriage with pretty much nothing but debt.

Joe: Probably not the best decision looking back on it, but things worked out.

Jim: That’s why we get married when we’re young. We’ve got the stamina to plow through some of those bad choices we make, not that getting married is a bad decision, but just the timing and debt. How about some stability here?

I think so many couples go through that. Many couples don’t make it through it. That’s the Number One killer of marriages is financial strain. We hear that all the time. Congratulations to you guys. I’m eager to jump to the good part of the story.

Joe: Yeah, we did the whole Dave Ramsey thing.

Jim: Good for you.

Joe: We went through his program. We did that together. Then with Amazon, we started doing that.

At the time, I don’t know if I knew you could sell anything else. I wasn’t sure if you could sell products. I don’t think I really even thought about it. I really liked selling textbooks. For the first few years, we used that to pay off our credit cards. I was selling primarily in the fall and also in January, just twice a year, that sort of thing.

Jim: When the kids were giving up their books, you were buying.

Joe: I was buying them, yeah. I was even going to different towns. We’ve got a couple of bigger cities close to us within a two-hour driving distance with several schools in each town. I’d drive there and line up people wanting to get books and do that whole thing. I did that for a couple of years.

Then I can’t remember who told me about it, but somebody – I was talking with somebody, a family friend and they told me about the Proven Amazon Course because I was looking at what can I do because I knew I could scale this. I know I can do something more with it, but I really didn’t know where to start.

Jim: Now, this is quite a while ago. How long ago was this?

Joe: I actually emailed support to see when I bought it. It was April 30, 2015, so it was years ago.

Jim: Wow, that’s incredible. Okay, yeah, the course is right around ten years old or so approximately. Yeah, to hear from a student who’s been around that long is pretty cool. I love it.

Joe: Right away, I dove right into it. I watched maybe three videos and I was just off and running. I went to Target. That was my first place where I got something other than a textbook. Found some stuff on clearance. From there, it was just – I was off to the races.

Julia: The rest is history.

Joe: I looked at my sales, so 2012 to 2014 I did about $20,000 in sales each year, which it’s not great, but –

Julia: That was a lot for us at the time.

Jim: For sure.

Julia: It was a big deal.

Jim: A few extra hundred dollars a month can be a really big deal when things are tight. Once you get in some stability, those numbers feel small. I look back at – my wife and I’s first apartment was $350 a month. We’re like, how are we going to pay rent this month at the time. It’s like, wow, if only our problems were that small now.

Julia: It’s true. Actually, we resonate with that part of the story, Jim, because when we got married, I had a townhouse. We ended up selling it as part of the decision to try to get out of debt and then moved into a little one-bedroom apartment. Of course, throughout the course of it, and you can talk more about this, but we’re now at the place where we just bought a really nice house in a really nice neighborhood. It’s all truthfully all because of Amazon and where just being a part of your community, being a part of the Proven Amazon. The coaching, we did that. We can talk more about that.

Jim: Being faithful, man; God is good. It hasn’t been an easy road. You’ve put in the work, the blood, sweat, and tears to get there. I’m sure there’s been plenty of doubts along the way too, but man, look where you are now. That’s beautiful. I’m enjoying this story. I want to go make some popcorn; I’ll be right back.

Joe: I don’t even remember where I was.

Julia: We were just saying that $20,000 was a lot to us.

Jim: Yeah, the books, the $20,000, but then you hit Target.

Julia: It is a lot.

Jim: You started to see some more potential, the Proven Amazon Course, which by the way, was just a list of videos. It was like one page. If I remember right, it was like one page of links to different videos and PR files.

Joe: At that time, it was actually a little bit more categorized but not much. I remember being overwhelmed for sure.

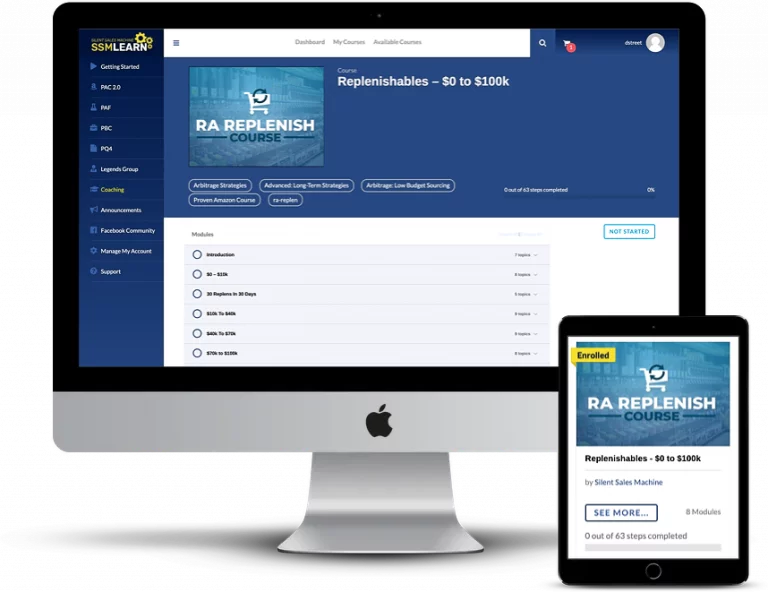

Jim: Sure, it was just a big page, one page of information with a whole bunch of links on it and some different categories perhaps at that point. It’s not the experience that people have now where it’s like a Netflix of categorized –

Joe: Oh, now it’s beautiful.

Jim: Let me ask you this, have you ever paid another dime for the Proven Amazon Course?

Joe: No, nothing.

Jim: Buy it once.

Julia: I’ve been able to use the same information. I’m logging in and I’m learning and I’m going through the same courses and that kind of thing, so 100% worth it. It’s amazing.

Jim: Awesome.

Julia: You knew that already or else you wouldn’t have asked that question.

Jim: Yeah, that’s true. Yep, that’s marketing. This episode is sponsored by Proven Amazon Course. All right, let’s keep it going. You started learning some new things. When you got into Target, you saw some new potential.

Joe: I did. I watched a few videos, started going to different stores. I don’t even know if I watched – I don’t know how many other videos I even watched of the course, but I just ran with it. In 2015, I ended up with $127,000, so it was an extra $100,000 from the previous year.

I believe I was working full-time at that time. This whole time, I’ve been working full-time. I just put in my notice for my job two weeks ago.

Jim: No way, congratulations. Have you quit yet or was that a two weeks’ notice like it’s coming up fast?

Joe: I gave them a month.

Jim: You’ve got two more weeks.

Joe: I’ve got two more weeks, yeah.

Jim: Then you’re done. That’s incredible. Did you get into counseling? That’s what you said your degree was in.

Joe: My degree is in counseling. I am a licensed professional counselor in Virginia, but I am not currently counseling. I’m actually doing something related, but not strictly therapy. I work for an insurance company that – it’s managed care. The company I work for works with the State of Virginia to help manage Medicaid costs. I help guide people who are on Medicaid and help them with making decisions that will help them with their health.

Jim: Sure, so this is a work from home thing I take it.

Joe: Work from home, yep. I’ve been doing that since 2017.

Julia: Before COVID happened.

Jim: Got you. Julie, do you still work outside the home?

Julia: I haven’t been working outside of the home since 2015. I’ve had a couple of small businesses myself out of the home. I’m a wedding planner and then I was also doing some party plan. It’s called H2O. I was doing party plan for a while.

We stopped doing that in December of 2020. I still have the wedding business, but of course, COVID took a major hit on the wedding business. The whole business is – it’s just slowed down significantly just because of COVID and then supporting him and raising kids.

Joe: Yeah, COVID coming last year for the wedding business anyway just totally decimated that industry because of the restrictions, but it was good because then she just pivoted. Then we started working together on Amazon.

Jim: Yeah, the perfect pivot business for families.

Julia: Yes.

Joe: It was perfect.

Jim: That’s awesome, very good. How involved in the business are you, Julia? Just give us a feel here for what percentage of it’s under your umbrella.

Julia: I don’t know; it really only started with when the shutdown happened in March of 2020. That’s really when I got really active with it. That was just sheer volume. He couldn’t keep up with as much as he was sourcing. I was prepping products at that point. We were shipping in together. I was doing some shopping. I was –

Jim: Sounds like you’re pretty involved?

Julia: I was, yeah. It really started last year. Before that, it was mostly just me managing the kids while he’s out shopping.

Joe: A great support person, for sure.

Julia: Now, I’m trying to handle some of the admin things, some of the behind-the-scenes accounting, and trying to work on taxes.

Joe: All the stuff I don’t want to do.

Julia: Basically, yeah. My skillset is the details, and the administrative stauff, and the systems, and the processes, and those kinds of things. Those are not his skillset. It’s funny because I’ve actually told my mother-in-law that I never imagined when God paired us together how our skill sets would be used, but they sure are every day with Amazon. It’s pretty awesome. Yeah, I’m just basically doing the admin type things and trying to set up for future growth.

Jim: Yeah, for some reason, this pops into my head. I don’t know if this will resonate. Hopefully, with the listeners, it will resonate. It reminds me, in the 90s, it became very popular to take these personality matching tests to find the perfect mate. Remember that was a really big deal like, we’ll match you with the perfect person stuff? We’d take these personality tests.

It was like, hey, this is you in the opposite gender. Like hey, you guys will have a great time. You love the same stuff. You’ve got the same personality types. I’m like, that’s a disaster.

Julia: Right.

Jim: You’ve got to be married to someone that’s different from you in as many imaginable ways as possible. I talk to these couples who’ve been married 20, 30 years. It’s like, we have very few character traits or personality types in common or likes, but we’ve learned to blend, to compliment.

Julia: That’s right, yeah.

Jim: It’s like one plus one equals five now.

Julia: We obviously share the same values and the big stuff.

Jim: Of course, those values are hugely important, of course.

Julia: It’s funny because we did actually meet on eHarmony. They did do that personality matching.

Jim: Shows you how much I know. They clearly did a pretty good job matching you two up even with all that debt.

Joe: Right, yeah.

Julia: Which we are out of, by the way.

Jim: Congratulations, again. What year did you guys get out of debt, by the way?

Julia: Oh Gosh.

Jim: Do you happen to remember?

Joe: I think it was 2018; it was a few years ago.

Jim: That’s quite a haul.

Joe: Yeah, it took us a solid five, six years at least, but we did it.

Julia: Yeah, we did it.

Joe: We still have a mortgage and everything, but we’re out of credit card debt.

Jim: Yeah, I’ve got you, man, I’ve got you. You’ve got a positive net worth and it’s growing.

Joe: Right, exactly, yeah.

Julia: It was really cool to see, too, Jim, because we – a while back, we were renting at the time. We actually created a vision board and talked through our – what our dream house would look like or whatever it was that we were working towards. Strangely, we closed on this house and looked back at that. We were like, oh my gosh, everything that we said on that list is here. It’s just really cool to see where we started, and where we’ve come from, and what we’ve – it’s been a ton of work. Of course, we’ve put in the hours, but I just think it’s really encouraging to see what can happen with a little bit of persistence, and a lot of hard work, and a lot of –

Joe: Writing things down. It took me entirely too long to realize that I need to start writing my goals, especially as a therapist. It’s almost embarrassing. It’s like write your goals down. What do I want to do with this business? What do I want to accomplish? What am I trying to – what numbers am I trying to hit? It’s simple, but for some reason, we make it difficult.

Jim: That’s a powerful activity to do as a couple as well that can have – here’s what we’re aiming for. It helps every decision be met with some clarity. Is this moving us closer to what we both agreed we were aiming for? If not, we need to talk.

It’s a really good thing to have that family vision. That’s phenomenal. We can do a whole episode on that, so many good, little, mini topics here so far. Let’s get it back on track on Amazon because where we left off the Amazon story, you’re in Target. You’re discovering some things. You had a $127,000 month.

Julia: Year.

Jim: $127,000 a year, which is $100,000 more than what you’d had previous. What were your margins approximately? Do you happen to remember?

Joe: Then it was in the upper 20s. Now, I’m a little lower at this point, but I’ve also got a lot more expenses. I hovered in that area for a few years, actually. In 2015 to 2019, I was in the hundreds. Like I said, I’ve had a full-time job this whole time, so I just – I don’t know what it is. I was trying to think about what it was that just clicked for me because in 2019, all of a sudden, I just felt like, hey, I want to do this. This is something I really want to go for.

I was in school for a while. It took a while to get licensed to become a therapist, so doing those things, I – my mind was in other areas. I think that just throughout the journey and throughout getting this done, it’s – this decision to go for it with Amazon, it just – it happened in like I said, 2019. I don’t know where it came from but –

Julia: That’s when you met with somebody in the community, remember. You had a conversation.

Joe: Yeah, but it was right before that, I think, anyway.

Julia: Yeah, but we just decided we wanted to be corporate refugees. We want to be – we want our time to be our time. We want our family – we want to live the life that we want to live. We just started working towards building that life, which he really got the bug in 2019 where he was like, I don’t want to work for anybody else.

Joe: Yeah, 2019 is really when it started getting serious. It was the fall of ’19 I joined Legends. I started out in that group. That’s when I started listening to the podcast. I’m not a big social media guy, so I specifically joined Facebook just to be a part of the Silent Sales group.

Jim: We’re honored.

Joe: Yeah, because I was fighting tooth and nail.

Julia: Listen, Jim, for a long time, he wasn’t even friends with me on Facebook because he didn’t want – because I’m connected to his family. He didn’t want the whole world knowing that he was on Facebook.

Jim: I totally get it. If there was a way to do what we do and just completely go around Zuckerberg, man, I’d be all in. It just happens to be the most convenient gathering place for now. We’re glad you’re on there with us.

You mentioned Legends. Real quick, too, any links or resources for the listeners’ sake that we talk about today, if you go to silentjim.com, go to the show notes for this episode. There will be a link to the Legends Group. We’ll explain what that is there. We can dive into it perhaps as part of your story if you’d like, but just so the listeners aren’t wondering, what did he say, Legends? What’s that? We’ll have a link in the show notes.

Joe: Yeah, both of those things, just joining those groups was a huge part of it because then I wasn’t an island anymore. I wasn’t doing my own thing. Another thing that took me too long to realize was especially with my background, is that it’s – you can’t do it by yourself; you just can’t. You have to have other people. There’s got to be just that community. You’ve got to be a part of the community.

When I joined, I noticed the change immediately. It was night and day because instead of – I made all these mistakes. I didn’t have anybody to lean on and couldn’t ask anybody questions or anything like that. I’m trying to do it all alone. Those years that I spent wandering there, I probably could have had way better years those years if I had been a part of a community.

Julia: I think it was important to get to the community part of it because it gave you resources for if you do get an IP complaint or if all these big, scary things that if you’re just starting out or if you’re on an island by yourself, you don’t realize that these things are very common and that they’re resolvable. It’s not the end-all, be-all because I remember there was sometimes when you would get an IP complaint or something and be like, I’m done. I can’t do this. Then it just helps you realize that everybody goes through it, this too will pass, those kinds of things.

Jim: That’s a great observation. The word image, I like word images. I think they stick with people sometimes. I think when you try to do this business by yourself, those molehills start to look like mountains.

Julia: That’s true.

Joe: Exactly.

Jim: When you have the community, those mountains can be approached as if they’re molehills like, oh yeah, the last 50 people who have talked about this, they did x, y, and z. They went on with their life. They didn’t lose any sleep. You’ve got this group now. It’s very validating and supportive.

The good book tells us in Genesis, man is not meant to be alone. He wasn’t just talking about marriage; he was talking about isolation is dangerous, even in e-commerce. I love that you’re pulling lessons and being very transparent with us, Joe, on, hey, I’ve been trained as a professional counselor. I should know these things. It’s like the carpenter who doesn’t fix his own house, the mechanic who has a broken-down car. It’s like, why haven’t I been doing this in my own life. I love the transparency.

Joe: Yeah, that was huge for me. I think a lot of it had to do with fear, too. I think there was a lot of fear there as far as what if I get suspended? What if this happens to my account? It’s just helpful to see other people going through those things and knowing how to get out of it and to not make it such a big deal. Yeah, that was a turning point for me; 2019, that’s when I joined the groups. Then COVID happened, obviously.

I’ll add another one to the list of something that I should have done long ago but outsourcing. This is something that I finally learned because I joined the groups is that I need to outsource. I shouldn’t be working in my business so much because, at that point, I was doing everything. I had done everything since 2012. I had prepped, I had shipped, shopped, everything.

Julia: A lot of early night – I mean early mornings, a lot of late nights.

Joe: I was working seven days a week. Joining these groups helped me – helped hammer it into me that I should be outsourcing. I shouldn’t be doing everything by myself. There’s no reason for that, but nobody can prep as good as I can; nobody can ship as good as I can, right?

Jim: Oh, you’re trying to get me on a soapbox; you’re trying.

Joe: That’s what you convince yourself of. You think that nobody’s going to take care of your business the way you are, which in a sense is true, but not for – there’s tasks that other people can do way better than you can do. It wasn’t until March when COVID really started to hit that we actually hired somebody to start prepping for us.

Last March, I ended up hitting $65,000, which was my best month at the time yet. Then we ended up losing her for – her kids were pulled out of school, so we ended up losing them. We went through a couple of different preppers before we finally found somebody who is awesome. She did a great job, way better than I ever did. It just goes to show, those fears were unfounded because now I’m so happy that I did that. I wish I did it sooner.

Julia: The cool thing is that they – she was actually out on maternity leave when she started helping us. She was desperate for a way to leave her corporate job and to be home with her baby. They’re now doing that. They started their own prep center, she and her husband both.

She’s home with her baby and she’s able to prep our products. They do a fantastic job. They’re able to resolve issues that we don’t even have to touch. We don’t even have to – a lot of the product just goes directly to their house. We don’t even touch the stuff anymore.

Joe: Yeah, they’re a legit prep center.

Jim: That’s fantastic. They live close to you, I take it?

Julia: They do, yep.

Jim: Your stuff’s just dropped off there now?

Joe: Yeah, I’ll drop it off.

Jim: It’s freed up space in your now bigger house.

Julia: That’s true, yes.

Joe: Because there was a point there where our whole house was just boxes and boxes – I had pictures of when my daughter was a little baby and there’s just boxes covering the living room.

Jim: That’s awesome. Send me one of those pictures if you don’t mind. We’ll promote it on this episode and say, hey, come meet these guys and see what they’ve got going on now. Maybe take a picture of your house now, before and after. Maybe with the same kid if you can pull it off. Now, we have space. Where did all the boxes go, Mommy?

Julia: That’s right, yeah. It’s just been cool too to just see this business benefit other families as well.

Joe: One thing I did want to add to that is that when she started prepping for us, she would come over to our house. During maternity leave, that was fine because she could do it whenever, but then afterwards, it got rough because they were having to come over at night time. We’re trying to get the kids to bed. It just wasn’t working out.

We decided to start dropping stuff off at their house. That was a great option. If anybody is having trouble with prep centers or they don’t want to do it themselves and they want an in between, dropping your stuff off at somebody’s house is a great idea because then you’re – you just don’t have to worry about it. You don’t have to worry about somebody coming over to your house; you don’t have to worry about getting a warehouse. It solves a couple of different problems.

Jim: We’ve got some multimillion-dollar sized replen businesses in our community that are run out of that exact model: a handful of neighbors shopping, a handful of neighbors prepping. The owner’s house doesn’t have anything going on it except managing the business. That model can be scaled out. I think there’s even opportunity there for creative international students to use that exact same model, too: prep centers and local shoppers. We have plenty of people who are doing just that, actually. Yeah, with some creativity, these problems are easily solved.

I’m amazed; I get on the Nextdoor app. I don’t know if you guys have that in your area or if you’ve ever used it, but every time, and some of the best people on our team have come through a post. I have to pull it down less than 24 hours after I put it up saying, hey, we’re hiring. Here’s the job. Spell it out in a few sentences. Text me if you’re interested. Just a short conversation later, you found another shopper. You could train them in half an hour, found another prepper if we need them. Take the stuff to their house. We don’t do much of that. We have our own prep center here. We are talking about doing more of that sort of thing. It’s not a complicated business. It’s just not.

Julia: Yeah, it doesn’t have to be, for sure. I think that’s what our journey has taught us that, I think, if anything else, because I just think that we complicated it for a little while.

Joe: It’s always me getting in my own way. That’s all it is. If I just get out of my own way, then it works.

Jim: Yeah, which as a professional counselor, I’m sure you’ve seen a lot of people you’re just sitting there thinking that. If this person would just get out of their own way. Here we are as business owners. I often say, that’s the ceiling in your business is your ability to lead and grow. That’s your ceiling, and to be honest with yourself, look in the mirror and actually know who you’re looking at. That’s the limit right there.

Hey, business-building warrior. Sorry for the quick interruption. Just wanted to make sure and remind you about our tremendous sponsor payoneer.com. If you need funding, up to $750,000, flexible repayment terms, no credit check, they love Amazon and Walmart sellers. They want to help you grow. Payoneer.com/funding, for 10% off the fees, be sure to tell them we sent you. All right. Let’s get back to the show.

That’s your ceiling, and to be honest with yourself, look in the mirror and actually know who you’re looking at. That’s the limit right there. You had a $67,000-month, in March you said, last year. As we’re recording this in September of 2021, a little over a year ago. Let’s start filling in the rest of the gaps here.

Joe: I waivered throughout the rest of 2020 just because we had trouble getting a prepper and keeping them and COVID was a little funky with that. By the end of 2020 is when our preppers were solidified for the most part. Then I started coaching in January. Abe McMahon, who’s awesome, he’s the best coach, love that guy. He’s our coach. He’s helped me a lot with – or helped us a lot with just getting – putting these plans in action, getting started with them prepping and also doing the shipping, that was huge because I was still doing the shipping there for a while. Starting I guess it would be last November, I didn’t write it down, but I’ve been averaging about $64,000 a month. I’m on pace to do between $750,000 and $800,000 this year without…

Julia: Without a monster Q4.

Joe: Yeah, not accounting for any change with Q4 numbers.

Jim: Right, which you will see a big Q4 because, like I said, as we’re recording this, we haven’t even entered Q4 yet. I think you could very realistically see significantly more business than that. That’s just saying, hey, if the numbers hold steady, you’re going to see $750,000 to $800,000 you said. By what margin?

Joe: About 23%.

Jim: Nice, very good, very well done. I’ve got to imagine that’s more than what you guys were making combined income when you were both working, right?

Joe: Yes.

Jim: The flexibility, just talk us through the lifestyle flexibility. What’s your routine now? What’s the day look like for both of you? Let’s include kid duties and all of that. Let’s be very realistic.

Joe: I’m still working. I still have my full-time job, but I’m at home, too, so it’s a little bit more flexible. It’s been phenomenal because, especially last year, we lost all of Julia’s income. Basically, all of her income was dependent on parties and weddings.

Julia: In-person events that weren’t happening.

Joe: In-person events, so we totally lost that. Having Amazon as a supplementary income helped us last year because we were able to stay home with kids, do hybrid school, all the stuff that we had to do last year because of COVID we could do. This year, it’s been a lot of the same. It’s been amazing because we can just get up and if there’s – we can adapt. It’s adaptable. My family lives in Saint Louis, Missouri. We try to go out and see them every couple – like twice a year, two, three times a year. A few years ago, we weren’t able to do that. With Amazon not being as big for us and with us both having full-time jobs, we were seeing them maybe once a year if we were lucky, but now, we can just pick up and go. I want to start going there a lot more now that I’ve quit my job, but that’s been great. The best part about that is that Tim Taylor has a prep center there now so we’ve been using his prep – I’ve just started using his prep center back in the summer so I can do the same thing there that I can here.

Jim: There’s no reason you can’t. That’s right. While you’re there visiting family, instead of just being in and out in a few days and nervous about how we took vacation time, no, stay for a few weeks, maybe even hire a shopper and a prepper while you’re there, working out of their house.

Julia: We just took a family vacation in August. I flew with the kids and he was able to drive. We went to Florida. He drove and was able to source the whole way back. It’s that kind of thing. The flexibility is unparalleled.

Jim: You have to love those tax-deductible vacations, too.

Joe: I’m an RA guy, too. I don’t know what it is. I just love doing RA. If I was financially independent, I’d probably still do it just because it’s fun for me.

Jim: I’m the same way. Literally, I drove home from – I had to pick up a couple things at the store for myself but I put about $150 profit. I just can’t walk past this stuff. I’m like, oh, there’s a $20 bill sitting right there. What am I supposed to do? Walk past it? No, I love the thrill of the hunt. The Replens model kind of dumbs it down to the level where it’s almost boring. When you first do it, you’re like, oh, wow, I’m finally finding profitable products. Then as you get into it, our list of replens is hundreds, I mean, over 1,000. It’s hard to walk through any aisle of any store without going, oh, there’s a $5 bill, there’s a $20 bill. You see it.

Julia: Also I think it’s worth mentioning, Jim, that we’re in a very, very, very small town in Virginia, we’re actually in a really big Minnonite population. We’re talking horse and buggies going down the street. I mean, we’re in a very small town, very small area. I think a lot of people think you have to be in a big city to be successful. I’ve talked with friends of mine and they’re like, oh, but we don’t have any stores within a two-hour radius of us. I’m like, if you have a Walmart, if you have a Target, if you have a grocery store, you’re good to go, a local hardware store, I mean, whatever. I just think it’s important. You don’t have to have a big city surrounding you. You don’t have to –

Jim: You could shop online, too.

Julia: Shop online, for sure.

Jim: I love that you pointed that out. I love when we kill excuses on this show. Well done. Someone is sitting there, oh, man, that was my last excuse, okay, I guess I have to try this. You guys are out there weaving between horse and buggies on your way to Walmart. How much further do you have to go to see another Walmart?

Julia: We have actually…

Joe: We’ve got two in town.

Julia: Yeah, we have two in town but we’re a little bit –

Joe: It’s not that small.

Julia: Our town is south of the city that’s got the Walmarts and stuff. We’re still in a pretty rural area.

Jim: Fairly rural area, yeah, great point.

Joe: 100,000 maybe.

Julia: Yeah, probably under 100,000 people in the city area.

Joe: Yeah, DC is two hours north. Richmond is two hours east. We’ve got some cities. If we really want to go do something, we can go.

Jim: Sure, do you guys ever travel much outside of your area to source or you pretty much source locally? Talk us through that.

Julia: You do a lot of the –

Joe: My thing is to do my sourcing trips. I think Ryan Robinson, he was on a couple weeks ago. I do similar to what he does. I’ll pick a big city around us and I’ll just go and spend a couple days, fill up the van, fill up the trailer, whatever, and then come back. That’s really been great because I just map it all out beforehand, decide which stores I’m going to go to, get on maps, map it all out, and then that’s it. Just take a trip and try to get as much as I can.

Jim: Like an overnight trip sometimes?

Joe: Sometimes two nights, yeah.

Jim: Then bring it back and drop it off at your prep center, your house, your friend’s house.

Joe: That’s the best part.

Jim: Great model.

Joe: Yeah, a van full of stuff and I can just drop it off and everything is all clean.

Jim: Sometimes you make it a family trip. Sometimes you head all the way to Saint Louis and do it. Fantastic model. This is really exciting. You’re looking at about $800,000 but that’s very conservative. I think it’s a safe bet you guys will break $1 million, assuming you have enough inventory to last the coming wave. This Q4 is truly insane. You guys have experienced it but I think this is going to be – there’s no question. This will be the biggest three months of online shopping in world history. It’s coming up very fast. I think you’re going to be blown away by what’s happening here, especially with all the lockdowns continuing in places and a lot of people still nervous to go out and all of that. I think we’re going to see – but there’s a lot of money out there so people are going to be shopping online like crazy. I think you guys are going to hit $1 million. That’s my theory, but $800,000 is a very safe bet from what you’ve said.

Joe: That was my goal at the beginning of the year. I ended up with $420,000 I think last year. This year I said I want to hit $1 million.

Julia: He wrote it down. He broke that down into number of units, average sale per unit number, how many units he needed to sell which equated to how many he needed to ship in. He broke it down and has it hanging.

Jim: Stacking those $2,500 to $3,000 days one after the other, right? That’s the plan. I love it. What lessons do you guys have or anything else you want to talk about from your story? Anything we skipped over, Julia, that you want to make sure and interject? This is the part of the show where I like to start to turn over to the guests and say take us where you want. What would you say to the listeners? Maybe they’re new. Maybe they’ve been doing this a while. What kind of things come to head or maybe even go into your counselling brain, there, Joe, and pull some lessons out. Dazzle us with your brilliance. Come on. You have that PhD, right? Let’s go.

Joe: Just a masters but I’ll try.

Jim: Oh, just a masters, okay.

Julia: I mean, I think a lot of it is, if you’re doing this with a partner, whether or not you’re in the business, I think it’s important to be in the business to be a part of it with your partner, with your spouse, because it takes a lot of trust. It takes a lot of communication. I’m basically just saying, whatever, if you want to go spend more money, go spend more money. You have to have good communication.

Joe: Yeah, it took a little while to get there, too, because it’s hard to see if you’re not in the business and I’m reinvesting the money back into the business…

Julia: You’re like, how much is on the credit card?

Joe: Where’s the money that we’re supposed to be seeing? It’s in the business. Unless you’re in the business, you don’t see that. That is important.

Julia: I mean, we’ve been through enough where we have that relationship. I mean, I trust him implicitly that he’ll come to me and be like, well, it’s a $400 investment. I’m like whatever. If you think it’s fine, if it’s going to further the business, do it. We’ve come to the point where I’m like, whatever. I trust that you’re selling enough to pay off this credit card. Some of it is a leap of faith but some of it is just open candid conversations and just keeping each other in the loop about where you are and where you’re hoping to go. I just think it’s important to be on board, treated as a team, because he wouldn’t be able to source if I weren’t on board with being home with the kid weekends at a time by myself, those kinds of things. I think just really treating it as a team, whether or not you’re in the business with your partner at all, and viewing it as such. I don’t know.

Joe: It doesn’t have to be that way either. I want to make sure that that’s clarified is that this is how we choose to do it. You don’t have to go away for nights at a time if you don’t want to to do this business. There’s hundreds of different ways to do this business. That’s the way that we fell into so far. I’d like to change that and get the ratios more wholesale and OA than RA here pretty soon. It doesn’t have to be that way. That’s a great point. I couldn’t have done this without her. She’s been such a great support.

Julia: Yeah, and I think, too, you have it written down on your notes. You talk a lot, Jim, about going inch deep, mile wide. I think that you’ve really embraced that concept, too, and that has helped with making the transition to going full-time. It’s just helped with peace of mind that all of our eggs aren’t in one basket. We’re both looking at other sources of income. We’re both open to whatever comes down the path. I think I just would really encourage people not to let fear dictate your decisions and not to let fear hold you back from what you could do with this business, what you could do for your family. Just jump. Jump now, think later. That doesn’t apply to him but…

Jim: You have the different personality types. You guys are doing it as a team. It sounds like it’s working phenomenally. I love you said inch wide, mile deep, Julia. I haven’t actually mentioned that in the show for a while. What does that mean to you, Joe? How do you apply that to your business? When she said that, what came to mind?

Joe: Back when I was doing it by myself, I would get really excited when I found a product and I’d buy a ton of it without testing just because I thought the numbers looked good. I had an intuition that it was going to do great. Then I’d get stuck with a bunch of inventory that I’d have to – luckily didn’t lose a lot but usually break even at least. I finally learned. I tried to spread the love a little bit and buy many more products but don’t buy as many of each product when I go out. It’s so much better. I don’t have so much stuff sitting on the shelves, inventory not sold, and obviously more money.

Julia: Just peace of mind, because if a listing gets shut down, you’re not dependent on that one item.

Jim: The entire Replens model is built on a list, a long list of different ASINs. At any given time, you’ve got a handful of those in stock. If one dries up, like you said, or you can’t find it or you’re unable to sell it or someone tanks the price, no big deal. Go find 5, 10, 20 more. Actually, that brings me to a point we didn’t really address much on this episode. I always like to hear, how do you find new replens? What are some of your favorite strategies? Do you find yourself in stores a lot? Do you take pictures? You’re doing it all yourself, too, actually a lot of people in our community, ourselves included, are using virtual assistants now. We send our VA pictures of local stores. She goes through and pours through and finds stuff we never would have found because we’re paying her a few dollars an hour and she’s thrilled to do it. How are you finding new replens? What’s your strategy?

Joe: I actually love that idea of taking the pictures and having somebody look for product. That’s going to be my next step. At this point, I’m doing a lot of – well, first of all, I do a lot of I guess it would be reverse sourcing where I’m just going on Amazon and typing in a brand and then just searching for products that way, searching for what’s profitable within the brand.

Jim: Seeing what jumps off the page. Anyone can do that. If you had to give us a really good 30-second summary of reversed sourcing, like I’ve never done it before. I’m on amazon.com. What do I do now?

Joe: A definition of reverse sourcing would be just looking for the product before seeing it on the shelf is how I see it. If you know a product you like or a product you know of, type in the brand name and then look for a listing based on – you’ll find numbers. If you see a two-pack of toothpaste and it’s selling for $15, maybe I should take a look at this because you could probably get that for cheaper at the store. Then once you find some products like that, you go to the store and you see if you can find them. I think it’d be better to do it in the store because then that way you know that the product is there, the product is actually on the shelf, because some stuff you’ll find on Amazon is discontinued.

Jim: Sometimes there’s a reason those two tubes of toothpaste are $23 because you can’t find them anywhere anymore and some people just really got to have it. That was a waste of time hunting all over town for that. That is the weakness of the reverse sourcing model. It’s the same analysis that we would do on any product of, is this a viable product? Can I buy it for a low enough price to sell it for a profit? Does Keepa say that it’s selling with enough frequency to justify it? This isn’t rocket science by any means. You do most of that yourself. You do a lot of reverse sourcing. That’s what you’ve done to get to this point it sounds like.

Joe: A lot of reverse sourcing, yeah, just typing in the product in the buyer’s app or the seller’s app even and just seeing what comes up. I think a big thing, too, is that it’s frustrating at the beginning because you don’t, first of all, you don’t know what you don’t know. You have to get some experience because I’ve been to so many stores and I’ve looked at so many shelves that I know what’s on what shelf. I recognize patterns. If I see something off in the pattern, I say maybe I should take a look at that because it’s something different that I haven’t seen before. It takes some time to just recognize what’s on the shelves between stores. Go to Walmart. What’s on Walmart shelves? What’s on CVS shelves, Target, whatever? Then when you go to different stores, you’ll find new products because you’ll have a pattern interrupt there. You’ll see something that you haven’t seen before. I found a lot of products like that, too.

Julia: I also think that’s a good place for a partner, whether it’s a romantic relationship or a friend or VA or whatever, just offer different perspectives, too. Because I’ll see things on a shelf that it wouldn’t have even crossed his mind that we should look into. We found several replens that way where I’m like, oh, yeah, of course, why wouldn’t you? This thing is only going for $0.99. I’m sure we could sell it for more, whatever.

Joe: It’s a part of the store that I would never go to.

Julia: Yeah, that’s a good thing about involving other people in doing your shopping as well because I just think you’ll get different perspectives and find things that you wouldn’t have otherwise.

Jim: Excellent, great tips. What average price point approximately are you playing around with?

Joe: Sales?

Jim: Yeah.

Joe: It’s about $21.

Jim: $21 per sale approximately? I got you. You’re buying $5 to $7 items typically and turning those. Got you. Have you played around with higher priced items at all?

Joe: A little bit.

Jim: Spend $50, sell for $100 or $200 kind of stuff?

Joe: I’ve got a few SKUs like that but I definitely want to look into that more because I think there was a recent podcast where he was talking about how he did that. I forget who it was. It made me say maybe I should try looking at some different price points.

Jim: For sure, we’re starting to do more of that ourselves. We’re seeing a lot of people doing that as well. As you get good at this, it doesn’t feel as risky anymore to get into those higher price point products.

Joe: Yeah, just check Keepa and you’re good to go.

Jim: Exactly, just Keepa. For people who are saying, what’s Keepa? I’ve referenced it so many times, Episode 369, go listen to it. It’s the tool that costs you about $20 a month. It’s really all you need. To scale up, you’re going to use some other stuff. I’m guessing you guys maybe have what, Inventory Lab, RevSeller?

Julia: Replens Dashboard.

Joe: Easy Insight.

Jim: Easy Insight and Replens Dashboard, phenomenal. Yeah, Jimmy and Carl doing a great job with that in our community. Yeah, so you get these other tools. You use them and you like them and you get your preferences, but Keepa is that foundational product. I explain why that’s such an important and unique tool in Episode 369 of this podcast. What else is in your bag of tricks? Anything else for us today before we start to wrap it up?

Julia: Yeah, I was going to say, too, I mean, this isn’t us trying to suck up. If you’re thinking about taking this business full-time or even just more than what you’re already doing, I 100% would tell you to invest in the coaching, the Jim Cockrum Coaching. I can’t remember the official name, whatever.

Jim: That’s it. We’re thinking about changing the name to something easier to spell, and etc., better marketing, but yeah, Jim Cockrum Coaching. It used to be just me and a handful of students. Then I couldn’t handle them so we started – we’re up over 35 coaches at this point. You mentioned Abe earlier. It’s successful students. That’s who our coaches are. Maybe you guys will be doing some coaching soon with all this new free time you’ve got.

Julia: We’d love to.

Jim: That’s awesome. Let’s connect you with Matt and make that happen. I’m sure there’s plenty of people listening to this right now going, man, I can really relate to those guys. I love their journey. Them as my coach, are you kidding me? Your inbox is going to fill. I can just predict it. I hope to bring you onboard officially.

Julia: No, but I’m very sincere in saying that. I mean, it really has changed our business. It’s changed the way we look at it. It’s changed trajectory of the business. It’s been 100% worth the investment. We’ve said that over and over and over again. Every time we get off the phone with our coach, Abe, we’re like, man, this was a good investment. So I just wanted to mention that as real life users, real life trainees that, if you’re thinking of going full-time, it is an investment, but it’s a huge investment in your business and it will change everything.

Joe: I had been selling for eight years at that point. I had a lot of bad habits to untangle. It’s helped me immensely. It’s totally worth it.

Jim: Never too late to get a coach. Some people think it’s just for new sellers. We’ve had multimillion dollar sellers come in and say, hey, I need some help. Because we work all the way up with high end branding and trademark assistance and that kind of thing and private label. We don’t talk about it a whole lot on this show because we don’t want new sellers thinking that’s the path we’re putting them on. We want them to start where you are. Build this $1 million a year business, then this wholesale opportunities and these private label opportunities, that’s the next chapter of your story as your time gets freed up. You look at some of these interesting niche products like, why couldn’t we sell this under our own brand? It’s flying off the shelf. Instead of making $5, $7 a sale, let’s make $30 a sale and sell it ourselves. Those are organic opportunities that are coming your way. We don’t like to start people there because it’s just so much time, effort, expense, and risk involved in the private label model. You guys are just more proof that following the basic plan, it’s certainly worked well for you guys. What a great story.

Joe: I’m so grateful. Can I just say one more thing?

Jim: Please do. No rush.

Joe: I would encourage anybody, whoever, I don’t know who needs to hear this, but join a group. It doesn’t matter what group it is. The Facebook group is great but it’s huge. There’s 67,000 people or however many on there. Join a small group. It doesn’t have to be – sometimes I think a mastermind sounds a little too maybe intimidating to some people where it’s like everybody has to be really good at one thing or something like that. It doesn’t have to be like that. Just get a few people together. You can all be brand new. It doesn’t really matter. Just join a group. Because it’s changed my business. It really has. I’ve got a couple groups that I’m in with different people. It’s phenomenal. It’s so nice to have somebody there or people there doing the journey with you.

Jim: One of the things I want to point out, some people may not be aware of, I don’t know if we’ve even talked about it on this podcast yet on any episode, but there’s a feature in Facebook that allows you to see who in this group lives near me, which is pretty cool. I highly encourage, if possible, local meet-ups. There’s a handful of other Amazon sellers in this area that right now are getting together at a Chicago’s Pizza. I was supposed to join them, but I’m like, oh, I’ve got a podcast episode, guys. Maybe catch you next time. Just the value of gathering live face-to-face is even more powerful. If it’s Zoom, that’s great. That reminds me, one of the things that happens organically at a lot of our live events is these kinds of groups just form and end up best friends and contacting each other about all kinds of stuff, doing life together. Because business-building warriors have a lot in common. We have a similar set of values. Family is important to us. We’re trying to build and serve. We have the frustrations of the latest Amazon changes and challenges. When we can do all that together, it’s a powerful thing. I’m glad you said that.

Yeah, everyone needs to have a group of people, someone ideally besides your spouse, especially if your spouse isn’t involved in the business, that you can go cry on their shoulder and they’ll actually feel sorry for you. Your spouse is like, yeah, I don’t know what you’re talking about right now. You get this group of people that get it. You guys are doing the business together. Not everyone does. I think you have to have them on the same team but not necessarily involved in the day-to-day nitty gritty but you need to have somebody who does understand the nitty gritty with you. That’s what you’ve been able to find in these groups, it sounds like, is some people to do this with. Good on you for mentioning that. That’s a great tip.

Julia: I was going to say in regards to that. In the wedding world, there’s a theme among vendors called community over competition. That’s really something to embrace in this model as well because when he’s talking about the groups, there might be people out there thinking, oh, my gosh, but I don’t want to share my secrets with somebody. You’re not going to get there alone. If you’re not in communication, if you’re not in community, if you’re not – I know, Jim, you’ve talked about this a bunch of times on your podcast, but community over competition is where it’s at. You’ve got to be willing to get into it with other people that are doing the same thing. I mean, that doesn’t mean that you necessarily share, hey, guys, I bought this item at this store for this much, but you’ve got to be willing to be vulnerable and you’ve got to be willing to let people meet you where you are and meet them where they are. I think that’s when the magic happens really.

Jim: Yeah, that’s a great tip. One of the things I announced at the very beginning of our most recent live event, and I think I’ve done this the past couple of ones, is, hey, you may look around the room and think you’re among competitors, you aren’t. You’re among people who are rooting for you, cheering for you. We want you to succeed. We can share 98% of our business with you. I’m not going to tell you, like you just said so well, Julia, I’m not going to tell you exactly where to go to buy the exact products you can start competing exactly with me on all the things I sell, but I’m going to tell you everything short of that. On Amazon, you can go in and look at any seller anyway and see everything they’re selling. Good luck finding some of it, different regions, even in Walmart there’s different regional store offers and things. That’s not like that’s some kind of secret magic button to have an awesome business. Some of that stuff we’re trying to get rid of. Worse thing you could do is go buy 50 units of this thing. We’re trying to get rid of it right now. Just because it’s on sale doesn’t mean it’s a hot winner. I can tell you how to find the hot winners. I can tell you what techniques I use, what strategies I use. Yeah, I love there’s a lot of transparency in this industry and in our community. That’s a great point, Julia, is share openly, build your community, because opportunities come and go, but relationships last beyond that. You can tackle the new challenges together. Great tip.

Julia: It’s about mindset, I mean, there’s a million people out there buying taco seasoning, you know what I mean? It doesn’t matter if there’s 20 other sellers selling it. I mean, there’s enough to go around.

Jim: For sure, yeah, we pass ASINs around like free candy. I’ll text just randomly and have someone pop in my head, a coaching student, I’m like, hey, here’s an ASIN for you. Go check this one out. I know you have this store in your area. Do that kind of thing and they’ll reciprocate. Beautiful. What else is on your mind? Anything before we start to land this episode?

Joe: The therapist part of me is going to come out right now but mindset is huge. Mindset has played such a huge role or it does play such a huge role in business or in life really, but with this business, that’s another thing. It took me a while to figure it out and figure out, first of all, the abundance mentality. I mean, for so long this famine mentality, it played me. I don’t know if that’s what that’s from. It could be from childhood. I don’t know, how I was raised. Once I got that abundance mindset, things changed there, too. It’s like the whole world just opened up to me.

Julia: That was a big game changer for you.

Joe: That might have been what happened in 2019 but I was just fed up with it. I’m fed up with just thinking that there’s not enough out there, that it’s too saturated, that Amazon is out to get me, or whatever. Just start thinking, hey, the Lord’s led me to this position, it’s for a reason. I’m going to just go out there and live like there’s too much. There’s too much out there. I’ve noticed the difference.

Julia: For sure, me too. I’ve noticed a big difference in him since starting the mindset stuff.

Jim: Yeah, it affects us at every level. I think one of the first keys, and this would be an interesting fun debate, again, another possible podcast episode in and of itself, but when I run into somebody who’s really battling that scarcity poverty mindset, one of the things I have them challenge themselves on is their gratitude. I think that is a key to unlocking optimism. That’s actually not anything I came up with. It’s a biblical concept from – Hebrews have understood that for thousands of years. If you’re struggling to be optimistic and positive, gratitude. That unlocks it. Then once you’re optimistic, it’s easier to have that abundance mentality. That’s the next step is look how blessed I am. Why not more? Why not serve more people? Why not hire more people? Why not go beyond? Things are so good now but they could be better. I’m going to work hard to make that happen versus nothing is ever going to work for me. Gratitude is the key.

Even Daniel Lapin, who was our keynote speaker a couple years ago, he had a brilliant presentation as his keynote. You can go back and look at it. It’d be around September. It was actually September 11th, almost exactly two years ago as we’re recording this now. He ended this brilliant presentation, this brilliant keynote with basically a challenge call to action to keep a gratitude journal. He connected the dots brilliantly between gratitude and more money in the bank. That’s weird. Just the most brilliant connection between those two concepts, more money in the bank, you need more resources, you want your business to grow, you want to serve more people well, you want to grow your team, expand, expand your territory, so to speak, gratitude, gratitude, gratitude. How’s that hit you as a counselor? Does that resonate?

Joe: Absolutely, yeah. Gratitude is a huge part of recovery. The main thing that we learned in the program was that it’s gratefulness. Be grateful because usually when you’re not like you just said, if you’re ungrateful, it’s not going to be a good thing for your life. That’s when you can spiral downward.

Jim: It’s toxic. It repels the people that you need in your life.

Joe: Exactly, yeah. That’s such an important part of it. I try to practice gratefulness every day. I mean, we’re just so blessed. I’m so thankful. I’m thankful, seriously, I’m thankful for what you’ve done, what you’ve started here. Everything has just been a life changer for us. We put in a lot of work but you following and doing what you were called to do has been a blessing on our lives, it’s been a blessing for our preppers, Blue Ridge Prep Services.

Julia: Blue Ridge Prep Services, got to give them a shoutout.

Joe: He came home because of that. He’s now a dad that’s at home with his little girl. We’re just so grateful for that. Thank you.

Jim: That’s phenomenal. Have the Blue Ridge friends reach out to us. We can put them on our list of prep centers. That’s another link I’ll stick in the show notes. It’s a free list. We just maintain it of, hey, here’s the people who are accepting new customers to do prep services. Have them reach out to us.

Joe: I think they are on there but I’m not sure.

Jim: Oh, are they? Okay, phenomenal. It’s a pretty comprehensive list. We have more people asking to be pulled off of it because it’s such a booming thing right now. It’s a lot of work. It’s not like a gravy business. You’re going to be working your tail off and you have to watch your numbers. It’s a beautiful business model that’s very much in need right now. Great hanging out with you guys. I wish we could order dessert and hang out for hours. This has been a great time. Our paths will cross, I’m sure.

Julia: Will you be at the Legends reunion, Jim?

Jim: I might be. I try to make – I’ve only made, I think, two of those over the many that they’ve had. Yeah, I love the Legends reunions. It’s a small group. It’s a group within a group. We didn’t talk much about Legends but think of our bigger group, it’s a few hundred thousand people around the world. Then you start drilling in the people who own the Proven Amazon Course, the people in our coaching programs, thousands of students there. Then you get into Legends, it’s several hundred, but it’s really people who know each other, recognize each other. They’re paying monthly to be in a more exclusive group of people who take this business very seriously, provenamazoncourse.com/legends. There’s even a second link, /legendstrial, it’s like a $1 30-day trial, I think, something like that. Those links will be in the show notes, too. Thanks for giving it a shoutout. I do hope to be there. Ryan and I go way back. He’s the one running the Legends group. He’s been on the podcast a few times. He’s actually hosted a few guest host episodes.

Julia: Yeah, hope to see you. Hope to meet you.

Jim: Yeah, I would love to see you guys, too. Please come up and say hey if I do end up crossing your path down there. That’d be awesome to see you guys live in-person.

Let me spend a couple of minutes talking to the listeners and thanking them. I think our guests today were phenomenal. They spoke with, the word that comes to mind for me is transparency, authenticity, just from the heart. They’re not trying to convince anybody of anything. They’re just telling their story. Their struggles, it wasn’t easy, we dove into recovery, we dove into struggles of a young marriage and now they have this cool new house, which I wish you could walk the camera around. That’d be cool to see the new place. Maybe we’ll do a tour some other time. That was so cool to see you guys make that step into this home, your dream home. Honored to spend time with you today. Hopefully you benefitted, listeners, as much as I did from this episode today. Thank you for giving us some of your time. We truly do appreciate that. We know it’s your most valuable asset. You gave a bunch of it to us today. We’re grateful for that. We want you to benefit in a tremendous way from that. Until we gather again next time, God bless you. We’re in your corner. Thanks to our guests, Joe and Julia. You guys did an awesome job.

Joe: Thank you. Appreciate it.

Jim: To all the listeners out there, we’ll have another great episode like this again real soon. God bless.